In so doing they are acting in a way which is directly contrary to Commissioner Hayne's recommendation that superannuation trustees not be allowed to assume any obligations which may conflict with their obligations to members. The retirement estimate relief is due to expire on 1 April 2022 and extending that relief and expanding the relief for superannuation calculators is part of the Government's and ASIC's project to provide more people with more and better financial advice by encouraging superannuation trustees to provide personal advice to their members about their superannuation. As for the relief from holding an AFS licence authorising the trustee to provide financial product advice at all, that too is of extremely limited value given most, if not all, trustees hold a licence with at least a general advice authorisation. Having said this, it is unclear what it would mean to provide an estimated retirement balance in the best interests of the member which of itself might suggest that what is produced by the calculator is not 'advice'. The relief does not provide any relief from the best interests duty which will apply if the calculator or forecast provides personal advice. Similar relief was granted for retirement estimates that permitted trustees to include an estimate of a member's superannuation balance at age 67 based on the prescribed assumptions. They required that the 'the financial calculator does not advertise or promote a specific financial product' and they required the user to be able to change the default assumptions in the calculator. You may recall that ASIC granted class order relief from the obligation to hold an AFS licence to provide financial product advice and to give a financial services guide or statement of advice for providers of 'financial calculators' if the conditions in the class order are satisfied. However, because you can add Additional Withdrawal amounts, you could make adjustments to the first few payouts if you needed to withdraw more to cover these types of fees.ASIC says that both calculators and forecasts provide useful 'tools' to members to think about their superannuation. For example, if interest is taxed at the rate of 15%, you can calculate a tax-adjusted interest rate as =(1- rate)*15%Įarly Withdrawal Fees: This is another thing that the spreadsheet does not take into account. That is usually a pretty good assumption, but if you want to take taxes into account, you can use a tax-adjusted interest rate.

#Retirement drawdown calculator australia free

The main assumption with regard to taxes is that the interest is earned tax free within the retirement account.

Taxes: This spreadsheet doesn't include any tax calculations. The Age column was added to the Google Sheets version, also.

#Retirement drawdown calculator australia update

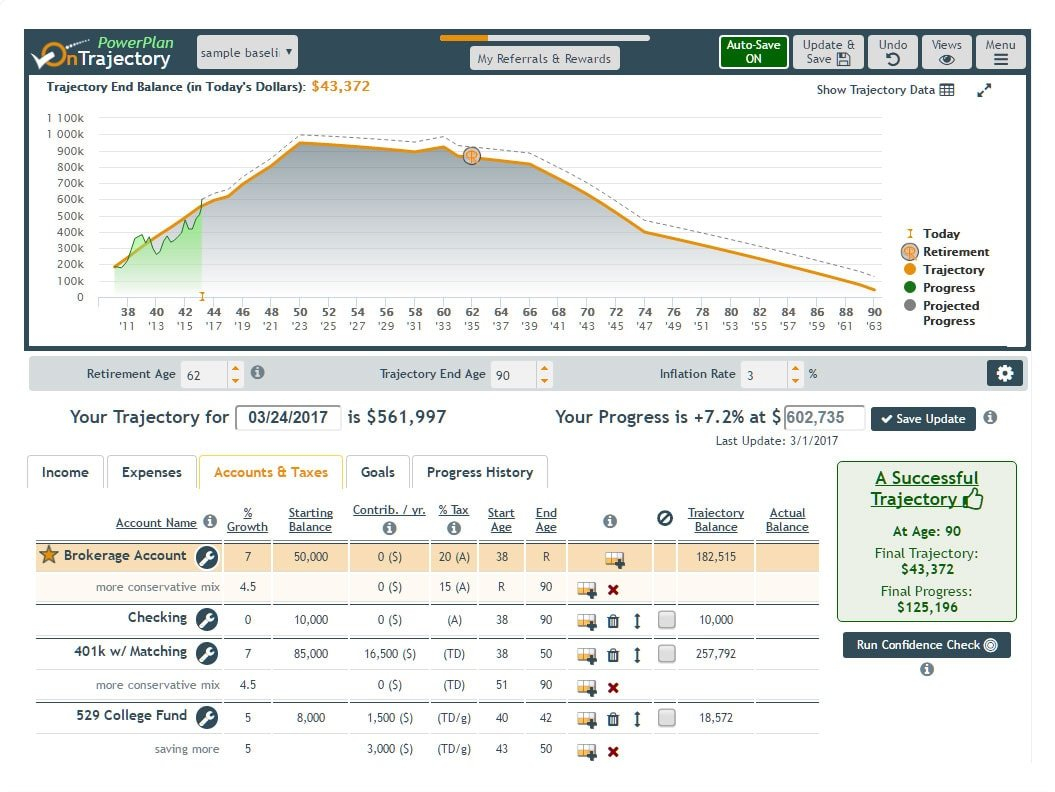

Update - The Age column in the table was fixed for the choice of an Annual withdrawal frequency. It should be adding the Withdrawal Amount column and the Additional Withdrawal column (not the Interest Earned column). Update - The error in the Total Withdrawals field was fixed (error introduced accidentally during update). The table includes an Age column and the graph uses Age as the horizontal axis. Choosing "beginning" means the first withdrawal is made before any interest is earned. Choose whether the withdrawal is made at the beginning or end of a month or year.

For example, you could use this feature to see what a huge one-time medical bill might do to the plan. Make adjustments to the normal scheduled withdrawal by entering an Additional Withdrawal amount within the Payout Schedule, either positive or negative. You are more likely to make monthly withdrawals, but for a quick analysis and a more concise payout schedule, the annual option is handy. Create a monthly or annual payout schedule. This is an important part of any retirement planning calculation. Enter an annual inflation rate to automatically increase the amount withdrawn each period. The initial withdrawal will be adjusted for inflation based on the number of years until your retirement. Enter the amount you expect to withdraw in today's dollars.

0 kommentar(er)

0 kommentar(er)